2024 Tax Forms and IRS Information

Pick up forms at the library

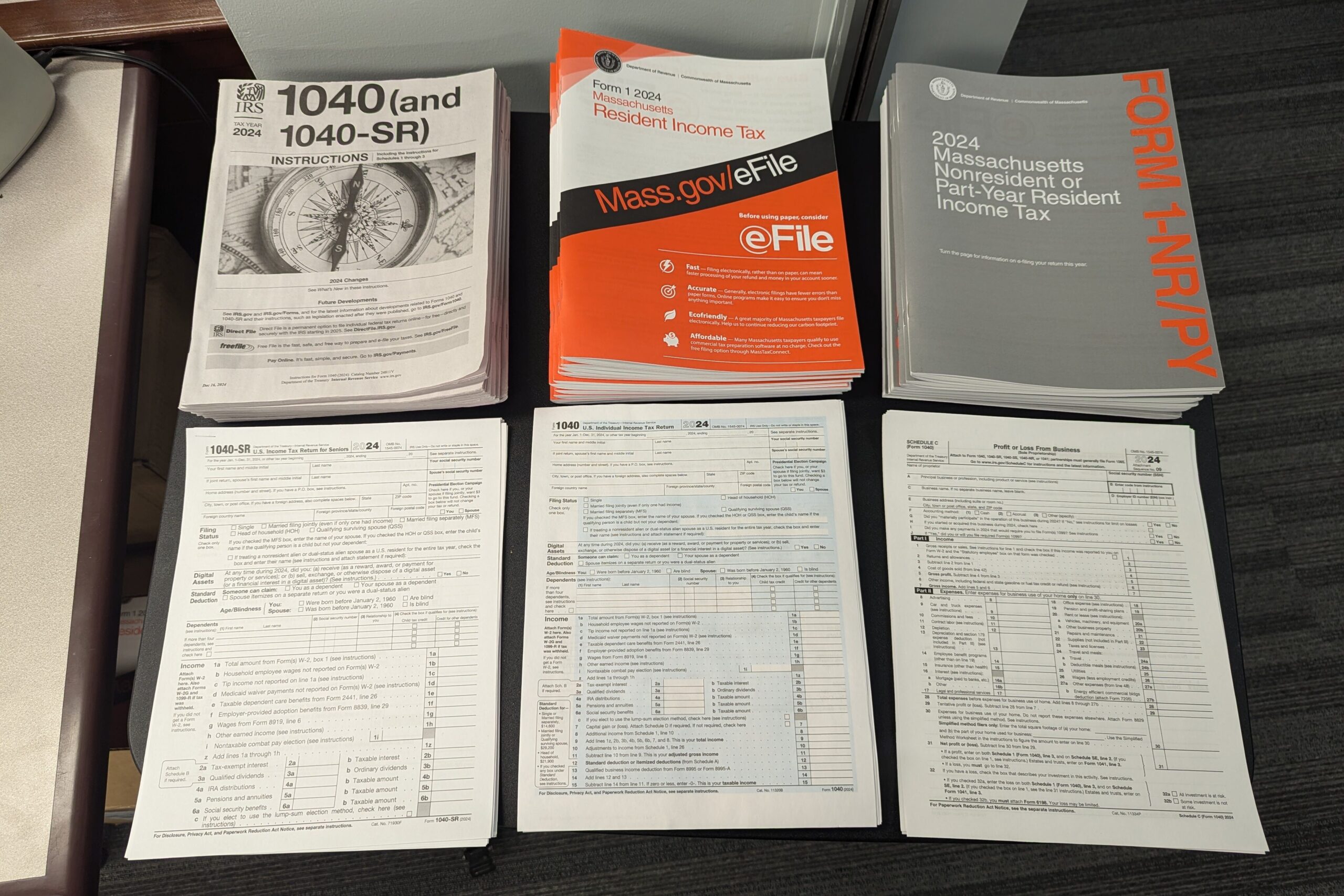

While supplies last, the library has copies of the following forms on the lower level. You can pick them up in person, or use the links below to download and print at home.

- 2024 Massachusetts Resident Income Tax: Form 1

- 2024 Massachusetts Nonresident or Part-Year Resident Income Tax: Form 1 NR/PY

- 2024 1040 U.S. Individual Income Tax Return

- 2024 1040-SR U.S. Income Tax for Seniors

- 2024 1040 (and 1040-SR) Instructions

- 2024 Schedule C (Form 1040) Profit or Loss Form Business (Sole Proprietorship)

Our librarians on the lower level will also print any other tax forms you need for free. Just come prepared with the name of the form(s) that you require.

Note: the library does not provide tax preparation services.

Additional Forms and Instructions

- All IRS forms, instructions, and publications

- All Massachusetts forms and instructions

- Massachusetts 1095-B and 1099-HC Tax Form

- Schedule EIC: Earned Income Credit

- Form 1040V: Payment Voucher

- Form 4868: Application for Automatic Extension of Time to File U. S. Individual Income Tax Return

- Form 8863: Education Credits (American Opportunity and Lifetime Learning Credits)

- Schedule ACTC: Additional Child Tax Credit (Form 1040)

- Instructions for Schedule ACTC: Additional Child Tax Credit (Form 1040)

- Form 911: Request for Taxpayer Advocate Service Assistance

- Trucking Tax Center

- Forms and Publications in Accessible Formats

Additional Resources

- Tax and Earned Income Credit Tables (from the Instructions for Form 1040 and 1040-SR)

- Tax Brackets Explained

- Interactive Tax Assistance

- Get an Identity Protection PIN

- Individual Taxpayer Identification Number Assistance

- Check or money order payments

- Payment Arrangements

- Account Inquires

- Prior Year Forms

- Understanding an IRS Notice or Letter

- Taxpayer Bill of Rights

- Filing or Paying Late

Filing Online

State Taxes: The Massachusetts Department of Revenue eFile platform MassTaxConnect is available at mass.gov/efile. Information about the MassTaxConnect service is available here.

Federal Taxes: The IRS online tax service Direct File is available in Massachusetts as long as you meet specific requirements. Check your eligibility for Direct File here.

For-profit electronic tax filing services are also available, including TurboTax and H&R Block Online.

Contact the IRS

- The closest IRS Office to Medfield is in Brockton, MA:

- Contact for an appointment: (844) 545-5640

- Location: 103 Commercial Street, 2nd Floor, Brockton, MA 02302

- For questions about available services or hours of operation, please call: (508) 586-4671

- Find additional IRS offices here